PM Youth Loan Scheme 2025

PM Youth Loan Scheme 2025 Government of Pakistan has relaunched the Prime Minister’s Youth Business and Agriculture Loan Scheme PMYB&ALS 2025, a life-changing opportunity for young individuals across the country to build a better future. This scheme is designed to promote self-employment and economic empowerment among youth, fresh graduates, skilled individuals, and small farmers. The most attractive features of the scheme include interest-free loans up to 500,000 rupees, no guarantee requirement, and a repayment period of up to 8 years, making it extremely accessible and sustainable for those who want to start or expand their businesses.

In today’s economic conditions, access to financial capital is a major hurdle for aspiring entrepreneurs and farmers. This scheme removes those barriers by offering flexible, government-supported business and agricultural loans through a network of both Islamic and conventional banks. With a transparent application system, simple eligibility criteria, and digital monitoring tools, the program ensures that even people from remote and underprivileged regions of Pakistan can benefit from it.

You Can Also Read: CM Punjab Green Credit Program 2025

Main Objectives of PM Youth Loan Scheme 2025

The core aim of this loan scheme is to reduce unemployment, empower the youth, and boost small and medium-sized enterprises SMEs and the agricultural sector. It is not just about giving money it’s about giving a chance to those who have potential but lack financial resources. By supporting startups and small businesses, the government is contributing directly to poverty reduction and sustainable economic growth.

This program also plays a critical role in encouraging innovation and self-reliance among young people. With various loan tiers, both new and existing businesses can grow according to their scale, industry, and funding needs. From IT startups to dairy farming, from e-commerce to tailoring units, this scheme welcomes a wide range of sectors, allowing entrepreneurs from all fields to benefit.

You Can Also Read: BISP 8171 Payment Verification May 2025

Loan Amounts Interest Rates and Tiers Explained

The PMYB&ALS loan scheme is divided into three tiers based on loan amount and interest rate, so applicants can choose the one that best suits their business size and repayment capacity:

Tier 1 – Micro Loans

- Loan Amount: Up to Rs. 500,000

- Interest Rate: 0% (completely interest-free)

- No guarantee or collateral required

- Loan Tenure: Up to 3 years

Tier 2 – Small Business Loans

- Loan Amount: Rs. 500,000 to Rs. 1.5 million

- Interest Rate: 5% markup

- Collateral may be required depending on the bank

- Loan Tenure: Up to 8 years

Tier 3 – Medium Enterprise Loans

- Loan Amount: Rs. 1.5 million to Rs. 7.5 million

- Interest Rate: 7% markup

- Security/guarantee may be required

- Loan Tenure: Up to 8 years

Each tier is designed to support businesses at different stages, from small startups to large-scale enterprises.

You Can Also Read: Ehsaas Program 2025 Bisp Payment 13500

Who Can Apply? Eligibility Criteria 2025

The scheme is inclusive and encourages both urban and rural applicants. Whether you’re a student, skilled worker, farmer, or female entrepreneur, if you meet the following conditions, you are eligible:

- Must be a citizen of Pakistan with a valid CNIC

- Age between 21 to 45 years (18 years minimum for IT and e-commerce sectors)

- Must have a business idea or plan (startup or existing business)

- Educational qualification: Matric or above, only required for IT-related businesses

- Farmers must meet SBP’s agriculture lending guidelines

- Individuals, sole proprietors, partnerships, and companies can apply (at least one partner must meet the age requirement

This broad eligibility framework ensures maximum outreach and inclusion, especially for women, minorities, and people from less-developed areas.

You Can Also Read: Maryam Nawaz Rashan Card Initiative

Step-by-Step Guide How to Apply for PM Youth Loan Scheme

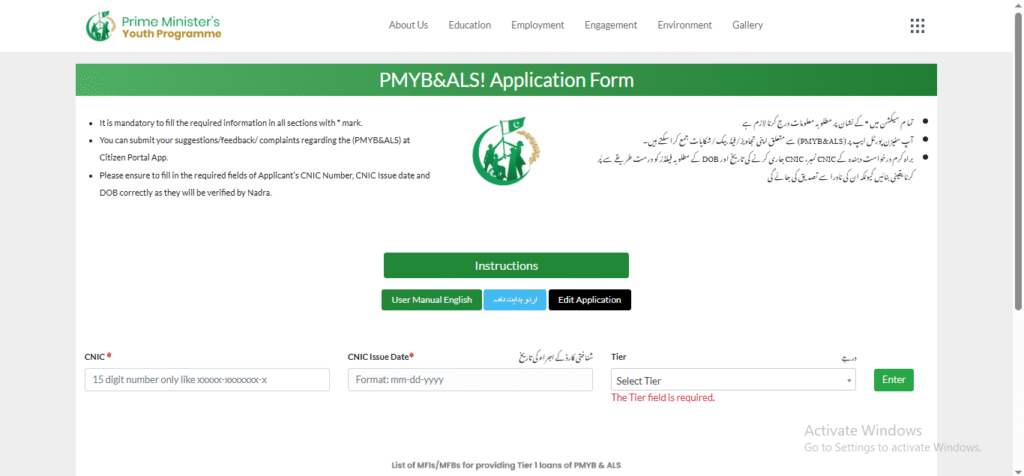

The government has made the process easy and entirely online. If you have all the required information and documents ready, it will take you around 15 to 20 minutes to complete the application.

Follow these steps:

- Visit the official website of the PM Youth Program

- Click on Apply Now button

- Enter your CNIC and issue date

- Select your loan tier T1, T2, or T3 according to your business need

- Choose your preferred bank Islamic or conventional

- Fill in your personal, business, and financial information

- Upload necessary documents like CNIC copy, photo, education proof, and business plan

- Review all entered data, agree to the terms & conditions, and submit

- You will receive a tracking number via SMS for future reference

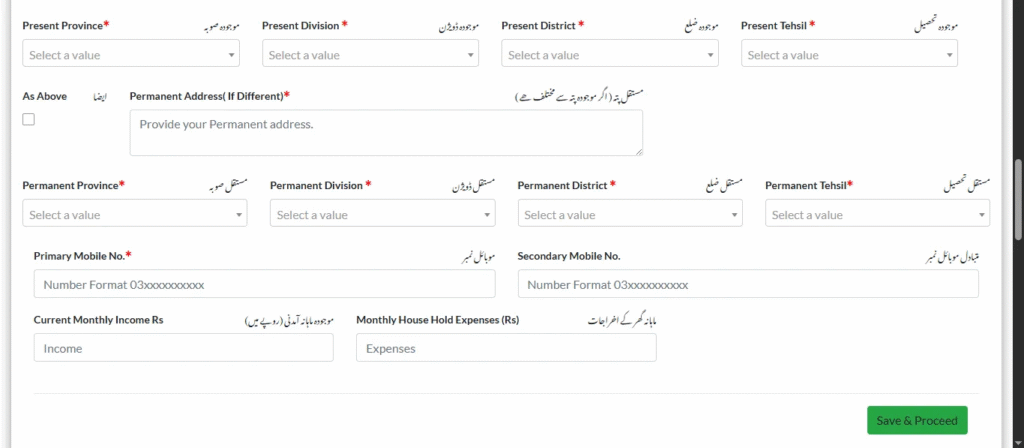

PERSONAL INFORMATION

Here you have to provide personal information that will be asked of you. You have to write the name of your bank, then write your full name, upload your photo, upload a photo of your ID card, then write the number of people under the loan, the date of issue of the ID card, the name of the applicant’s father or husband, marital status, whether you are disabled, write your degree information, write your full address, then click on the Safe Information button.

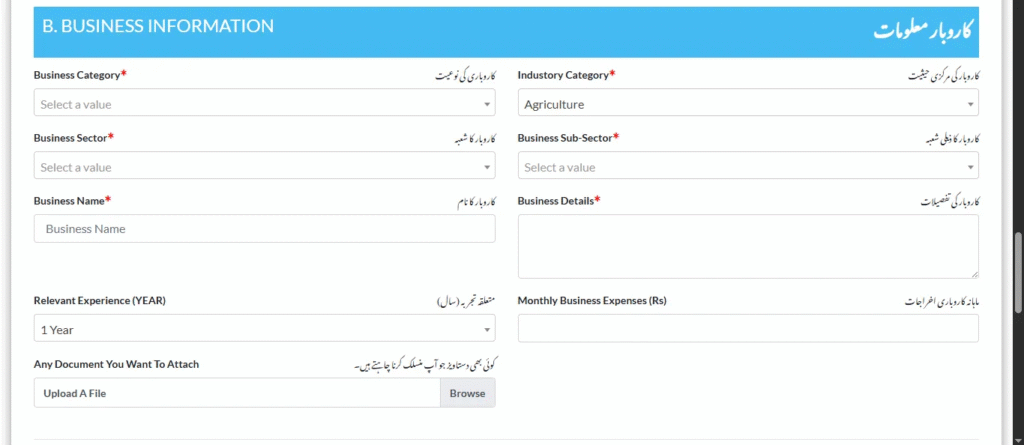

BUSINESS INFORMATION

Here you have to write complete details about the business, what kind of business you do, how much business details you have, in addition to one year of experience, monthly turnover or expenses.

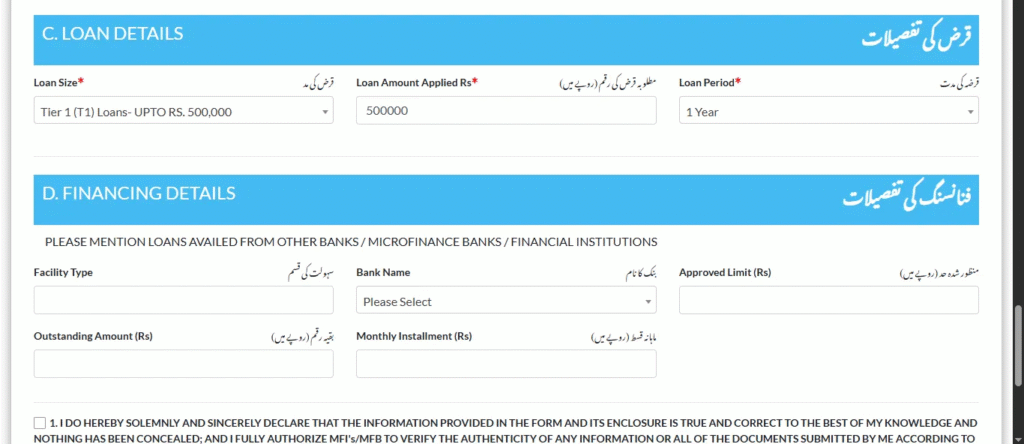

Loan Details

You have to write the details of how much loan you want and then click on the submit button.

Documents Required for Application

Before starting your online form, ensure that the following documents are available in digital format:

- Valid CNIC copy

- Recent passport-size photo

- Educational certificate (for IT/e-commerce sector)

- Business plan (especially for Tier 2 and Tier 3)

- Bank account details

- Utility bills (for existing business premises, if applicable)

You Can Also Read: PM Laptop Scheme 2025 Who Can Apply

How to Track Application Status Online

Once submitted, you can easily check the status of your loan request:

- Visit the PM Youth Program portal

- Click on Track Application

- Enter your CNIC number, issue date, mobile number, and date of birth

- Press Submit

- Your application progress and decision status will appear on the screen

The online system keeps the process transparent and reduces the chances of favoritism or delays.

Important Tips for Success in Loan Approval

To improve your chances of getting approved, follow these expert tips:

- Use a valid and active mobile number registered under your CNIC

- Double-check your uploaded documents for clarity and correctness

- Make sure your business plan is realistic and well-prepared

- Select a bank that has a good track record of processing such loans

- Do not submit multiple applications it may lead to rejection

You Can Also Read: CM Punjab Kisan Card Updates Loan Amount Increased

Final Thoughts

The PM Youth Loan Scheme 2025 is more than just a loan – it is a practical tool for economic development, financial inclusion, and youth empowerment. With the availability of interest-free loans up to Rs. 500,000 and highly subsidized loans up to Rs. 7.5 million, the government is removing the traditional financial barriers that often discourage business-minded youth in Pakistan.

If you have a dream, an idea, or a plan to build something of your own whether it’s a small shop, a digital agency, or an agri-based venture this is your moment. Apply today, take control of your financial future, and contribute to the progress of your country through entrepreneurship.

FAQs

1. Who can apply for the PM Youth Loan Scheme 2025?

Pakistani citizens aged 21 to 45 with a business idea or existing setup can apply.

2. Is the loan really interest-free?

Yes, loans under Tier 1 (up to Rs. 500,000) are completely interest-free.

3. How can I apply for the loan?

Visit the official PM Youth Program website and apply online by filling out the application form.

4. What documents are required for the loan application?

You’ll need a CNIC, recent photo, business plan, and education certificate (for IT-related businesses).

5. How long does it take to get loan approval?

Approval time varies, but you can track your status online using your CNIC and tracking number.

6. Can I apply again if my application was rejected?

Yes, you can reapply after correcting any issues in your previous application.